Japan's Glued Laminated Timber Market projected to surpass USD 1.8 billion by 2034, with a steady 3.5% annual growth rate.

In the realm of sustainable construction, a material named Glulam is making significant strides, particularly in Japan. This engineered wood product, known for its strength and versatility, is becoming increasingly popular due to its unique properties and the growing demand for eco-friendly materials.

The market for Glulam in Japan was valued at USD 1.3 billion in 2024, and it is projected to reach USD 1.8 billion by 2034, growing at a CAGR of 3.5%. This growth can be attributed to various factors, including government initiatives, technological advancements, and the increasing trend towards sustainable construction practices.

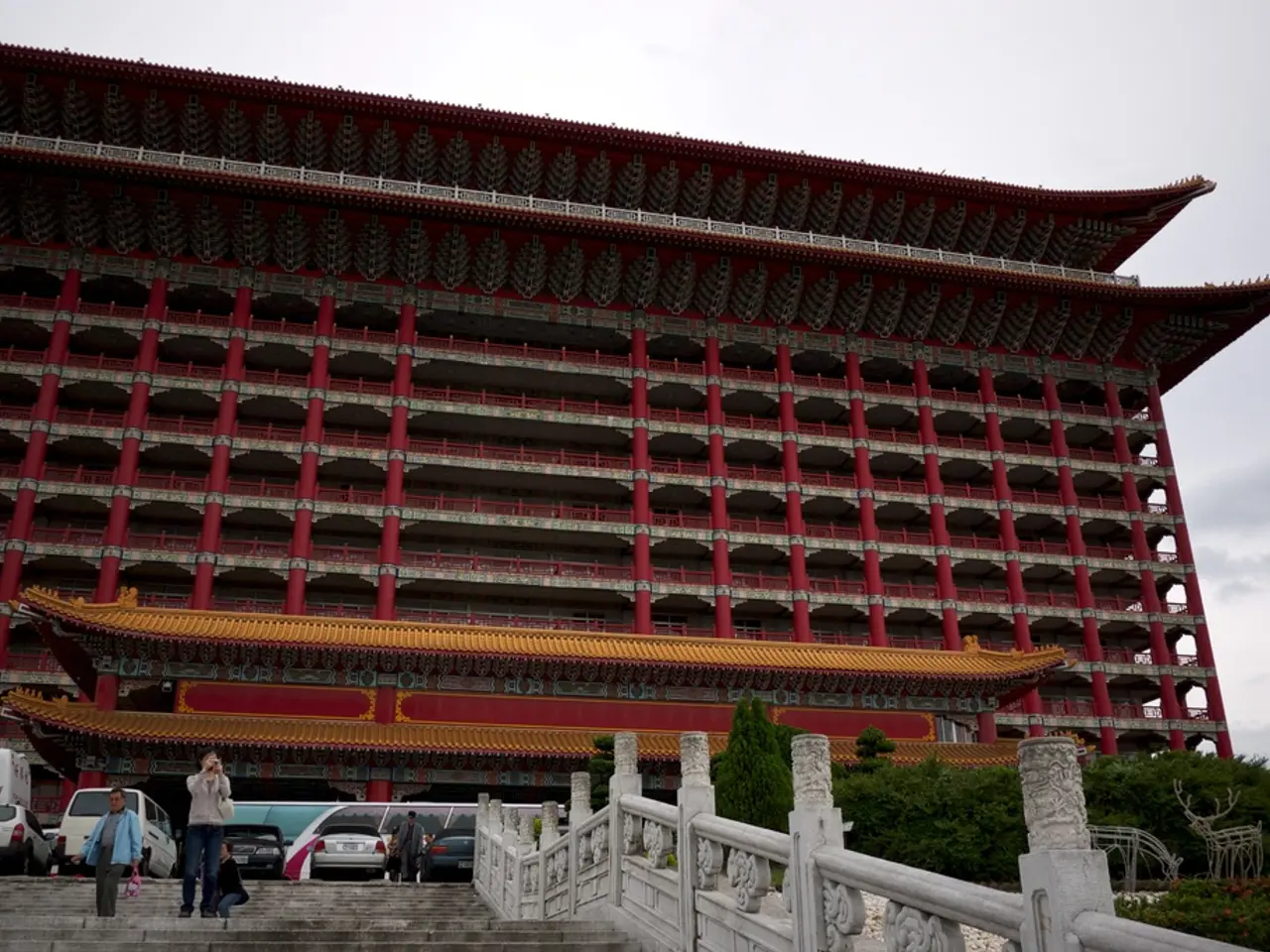

One of the key factors driving the adoption of Glulam is its impressive strength-to-weight ratio, making it suitable for bridge construction. Its ability to span large spaces without internal supports also makes it ideal for commercial applications, accounting for 34.4% of the market. Glulam is extensively used in residential construction as well.

In the educational sector, efforts are being made to increase awareness and training about Glulam's benefits, with the aim of expanding its use across various construction sectors. This increased knowledge can lead to innovative Glulam applications, enhancing its market appeal.

Technological advancements are playing a significant role in enhancing the quality and versatility of Glulam products. Horizontal Lamination, for instance, led with a 43.2% share in the lamination process. These advancements can lead to new Glulam applications, further boosting its market appeal.

Government initiatives are also playing a crucial role in promoting the use of Glulam. Policies favouring wood-based construction can boost Glulam's adoption in public projects, such as schools and community centers. Government support is encouraging the adoption of Glulam in public structures, contributing to the growth of the market.

The market landscape is competitive, with key players including JK Holdings Co. Ltd., HASSLACHER Holding GmbH, Holzindustrie Schweighofer GmbH, Forssell Timber, FM Timber, Sanno Housing Co. Ltd., Stora Enso Oyj, Keitele Forest Oy, Mayr-Melnhof Holz Holding AG, Boise Cascade Company, D.R. Johnson Wood Innovations, and Meiken Lamwood Corp.

Notable developments in the market include the entry of the HASSLACHER Group into the North American market in 2024 by acquiring a stake in Element5, a Canadian mass timber producer. ITOCHU Corporation also partnered with Mukai Kogyo Co., Ltd. in 2025 to establish FORJ Co., Ltd., focusing on the production and export of Japanese cedar lumber.

Stora Enso, a significant player in the market, secured a steady wood supply for its packaging board site in Oulu by acquiring Finnish sawmill company Junnikkala Oy in 2024. Nippon Life Insurance also expanded its services in response to Japan's growing elderly population by acquiring Nichii Holdings in 2023.

The growing demand for sustainable construction materials presents opportunities for Glulam in the market. Glulam is favoured in renovations for its adaptability and ease of integration with existing structures. Urbanization trends create demand for materials like Glulam that offer both structural integrity and aesthetic value.

Moreover, environmental product declarations and sustainable production processes are influencing the market, with companies like Mayr-Melnhof Holz, a German company, having a significant impact on the Japanese Glulam market in 2024.

In conclusion, the Glulam market in Japan is on an upward trajectory, driven by a combination of technological advancements, government initiatives, and increasing demand for sustainable construction materials. As awareness and understanding of Glulam's benefits continue to grow, it is expected to become an even more integral part of the construction industry in the future.